by Ram Krishnan, Advisor & Retired Operations Executive

To build a high value company, an entrepreneur must convince investors that the addressed market is large, that the company is capable of meeting market demand and that the profit margin can be maintained regardless of market conditions. In addition to the revenue and profitability requirements, such financially attractive markets are characterized by tough quality requirements and rapidly eroding average selling prices (ASP). A good example of such a market is the smart-phone market where annual volumes are in the hundreds of millions, selling prices erode at 20-25% per year and quality requirements are stringent.

An entrepreneur will typically focus on product development and sales channel development early on, but production volume, yield and quality are perhaps the last items he worries about. The objective of this paper is to make a business case for including operational issues such as the production process, yield and quality early as part of the overall strategy. The founders of InvenSense conceived of the production process during the product concept phase and as we shall see, this paid off handsomely as measured by the company’s strong and sustained market value.

InvenSense’ historical results

InvenSense’ results (details can be found in the company’s SEC filings) were:

- Founded 2003, IPO 2011

- Products: MEMS-based motion sensors

- Addressed markets: Gaming, smart phones and digital still cameras

- Spent $19M in venture capital to reach profitability, currently valued at >$1B

- Annualized Revenue run rate of ~$200M

- Operating Profit: 22% to 34% last 4 years

- Delivered 50-55% gross margin for 4 years

- World-class quality, meeting the standards of Samsung, Nintendo and others

- Designed into most major smart-phone platforms

- New, high-volume product every year (on average)

- 2nd fastest growing Semiconductor company (Deloitte Fast 500)

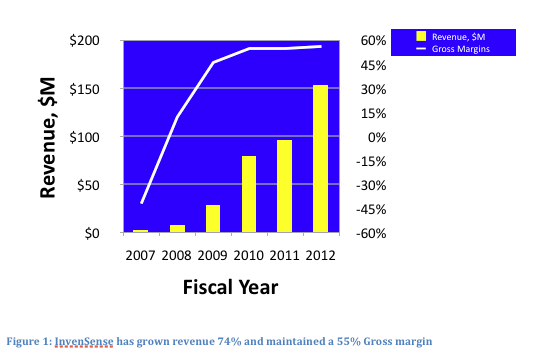

The chart in Figure 1 shows the rapid rate of revenue growth (74% in the last three years) and by inference, the capability to ramp volume production quickly. Figure 1 also shows a steady gross margin of 55% for the last 3 years, once high volume was established in 2010.

In addition to the rapid revenue growth and strong gross margins, the quality levels met the stringent requirements of customers such as Nintendo and Samsung.

The following is a non-exhaustive list of the many factors that led to these impressive results:

- Design for manufacturability (ref 1)

- Operations infrastructure built to support continuous improvement

- Culture of execution (new product every year, steady gross margins, etc)

- Tight, top-down cost control

This paper will focus on Factors 1 and 2 and their impact on the company’s financial success.

The importance of design for manufacturability in financial performance

If a startup (or for that matter, an established company) enters a large, attractive market such as the cell-phone market, it is almost certain to encounter competition. Further, if the startup introduces a breakthrough product that is successful, the product introduction should be viewed as the start of a competitive race where product features and market acceptability are revealed to the competition. From that point on, the startup’s ability to ramp the production volume to meet the market’s volume demand at the right price and quality becomes a critical factor in keeping the competition from gaining entry. Of course, there may be other factors such as customer relationships that will enable a competitor to get in but clearly, an inability to meet a customer’s volume demand could provide an opening that a competitor can take advantage of. Further, if the startup can develop a production process that not only enables a fast volume ramp but also can be patented, it can then be used as a defensive barrier to entry against competitors. The founders of InvenSense were clearly aware of this and invented a new process called Nasiri Fabrication (NF) that significantly simplified the volume production process and, by patenting the new process, they erected a significant barrier to entry for the competition.

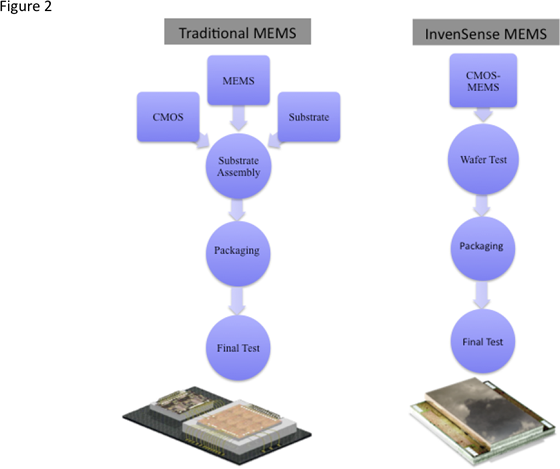

MEMS devices must be electrically connected to a CMOS device to be testable and to function as a product. Prior to InvenSense’ introduction of NF, MEMS production was traditionally a non-standard wafer fabrication process performed by relatively low-volume foundries who could only produce MEMS wafers. Thus, to produce a complete MEMS-based product, a CMOS wafer must be obtained from a traditional CMOS foundry and the MEMS and CMOS die are then assembled as a SOC device on a substrate before the product can be tested (see Fig 2, flow chart on the left). Thus, a defective MEMS die cannot be detected until it has already been assembled with a CMOS die onto an expensive substrate, at which point the entire defective assembly would have to be scrapped resulting in a high yield cost. NF simplifies this process by integrating the CMOS and the MEMS wafers together both mechanically and electrically and at the same foundry (see Figure 2, flow chart on the right), thus making them testable and simplifying procurement. This eliminates the previously high cost of losing the entire substrate assembly because of a defect in the CMOS, MEMS, substrate or assembly process. But the biggest advantage of this process is that capacity ramps are greatly simplified and can be negotiated with a single foundry. The capability to increase capacity quickly was further enhanced at InvenSense when major CMOS foundries such as TSMC and Global Foundries jumped into MEMS production. Thus, InvenSense was able to quickly ramp the volume of testable CMOS-MEMS wafers to meet market demand. For a more detailed description of NF, please see Ref 1.

Figure 2: The InvenSense process using Nasiri Fabrication significantly simplifies the production flow

The role of continuous improvement in a company’s market value

The ability to meet the markets volume demand by itself is not sufficient to enhance a company’s value. It must also have the ability to maintain a steady and high profit margin and satisfy customers’ quality requirements. The continuous improvement process is much discussed as a tool for these objectives. At InvenSense, hooks needed for setting up a continuous improvement process were designed in and a team, tools and process built early on. To understand the need for early establishment of the continuous improvement process, it is helpful to again think of a successful product introduction as the start of a race: in competitive markets such as the smart-phone market, the quality requirements are stringent, typically requiring 300 ppm defect rates or better but in addition, the selling price erodes by 5-10% every quarter after production starts. Typically, new products are introduced as soon as they are manufacturable at acceptable quality and yield levels that may not be optimal from a quality or cost point of view. Most often, the task of quickly improving cost and quality falls upon Operations after product introduction. The rapid selling price erosion and customers’ quality requirements only serve to increase the time pressure. Thus, a process must be developed that enables the Operations team to rapidly diagnose and fix failures in production which will lead to a correspondingly rapid yield and quality improvement. Yield improvement is of course directly related to product cost and subsequently profit margins. Thus, such a rapid continuous improvement process is necessary to maintain a steady gross margin in the face of rapidly eroding ASPs. In turn, the steady and high profit margins positively affect the market value of the company. For the InvenSense product, early establishment of the continuous improvement process meant establishing the following:

- Each unit is programmed with a unique device ID (during testing)

- A database system was built early to record the test performance of every device

- Diagnostic software was built that could display the wafer map location of any defective die, its performance in wafer sort and final test and chart a Pareto of failure modes for each lot

- A product engineering team was trained to rapidly correlate failure modes to root causes in process or design, thus leading to rapid corrective actions

With such a process in place, InvenSense was not only able to handily meet (and often beat) customers’ stringent quality requirements but also maintain a steady gross margin in spite of 5-10% quarterly ASP erosion. Figure 3 shows the continuous improvement process diagrammatically.

Figure 3: The InvenSense Continuous Improvement Process

The role of die-shrink in maintaining gross margins

Die shrink projects are a critical component in maintaining gross margins in the face of eroding ASPs and the InvenSense design team has a remarkable track record in this area. For example, the die size of the first generation 6-axis device was approximately the same as the first generation 3-axis device. However, most large customers require a full customer qualification of die-shrink projects and are often reluctant to assign a team during a current product cycle. This, in effect, eliminates die-shrinks as a tool for short-term gross-margin maintenance. However, die-shrinks are the only way to go for longer term cost reduction, as they can typically reduce cost by significant amounts compared to yield improvement alone.

Summary:

Market valuation is a critical part of any startup’s success and is dependent on the company’s ability to meet market demand, maintain a steady gross margin and meet customers’ quality requirements. This paper makes a business case for early operations planning in order to meet these requirements. InvenSense, a very successful MEMS sensor company is used as a case study to illustrate the point.

Reference: “Development of High-Performance High-Volume Consumer MEMS Gyroscopes”, Joe Seeger, Martin Lim and Steve Nasiri, www.invensense.com

Leave a Reply